Wise Choice

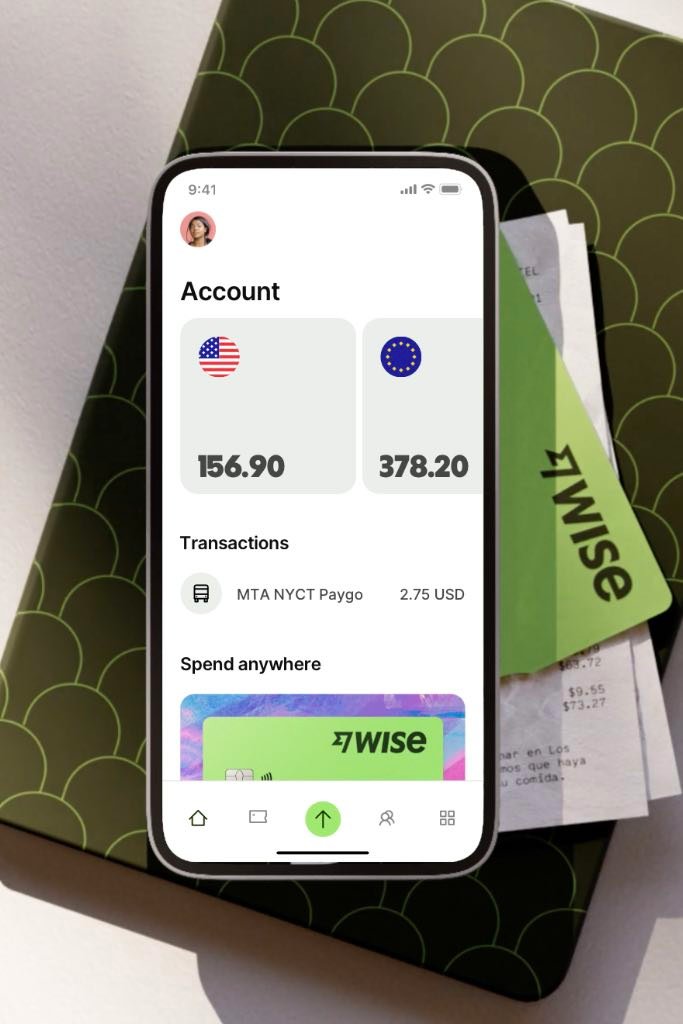

The Wise debit card is one money product I use regularly and don’t travel without. I’ve used Wise while in Italy earlier this year and more recently in Amsterdam, London and Brussels. I’ve used it for purchases made online in foreign currency, either products or services in US dollars or accommodation and trains in Europe and the UK in Euros or British Pounds and accommodation and transport in Singapore in Singapore dollars as well as POS purchases at supermarkets, eateries and pharmacies. All done in their respective currencies and bought at favourable exchange rates.

In Italy I paid for all my train tickets, fast trains and regional trains and the Leonardo Express from Roma Termini to Fiumicino Airport. All booked with the Italian state railway company Trenitalia and effortlessly done with the Wise app on my smartphone (in my case the iPhone). Important though to have data either through a local SIM (or eSIM) or one that allows you international data. You have to remember when dealing with money your connections have to be secure so preferably do not use hotel or airport WiFi etc.

Shopping at supermarkets is also a breeze via contactless POS, either by tapping the physical card or the smartphone (Apple Pay, Google Pay, etc.).

As a travel debit card I do recommend Wise for the excellent foreign exchange rates and low transaction fee when buying foreign currency. It is a great alternative to carrying too much cash and very competitive compared to travel money cards (issued by banks, Travelex etc.), credit cards and other debit cards (that banks charge and then gouge you on non-favourable exchange rates).

The Wise debit card does have one drawback, luckily the only one, it’s the limited number of ATM withdrawals that can be made per month and the amount of cash capped at a low $AUD300.00. I don’t withdraw money from ATMs especially those I’m not familiar with so I am not too fussed about withdrawing money from ATMs. I get around this by carrying some foreign currency in cash that I purchase (exchange) either back home or at the better known bureaus abroad. Of course you can negotiate at all bureaus and perhaps get a slightly better deal than what is advertised, just make sure to check rates on your smartphone. I use XE. Their rates are refreshed every 60 seconds. Visit XE or use their app. Remember rates quoted are mid-rate so leave a small margin for the bureaus to make their money. The rates on Wise are much, much closer to the mid-rate.

My perfect combination: the Wise card, some cash and a credit card for pre-authorisations. This is all you need when travelling.

In summary Wise is quick and easy to use either via: physical card or mobile app with Apple Pay, Google Pay, etc. You can’t go wrong.

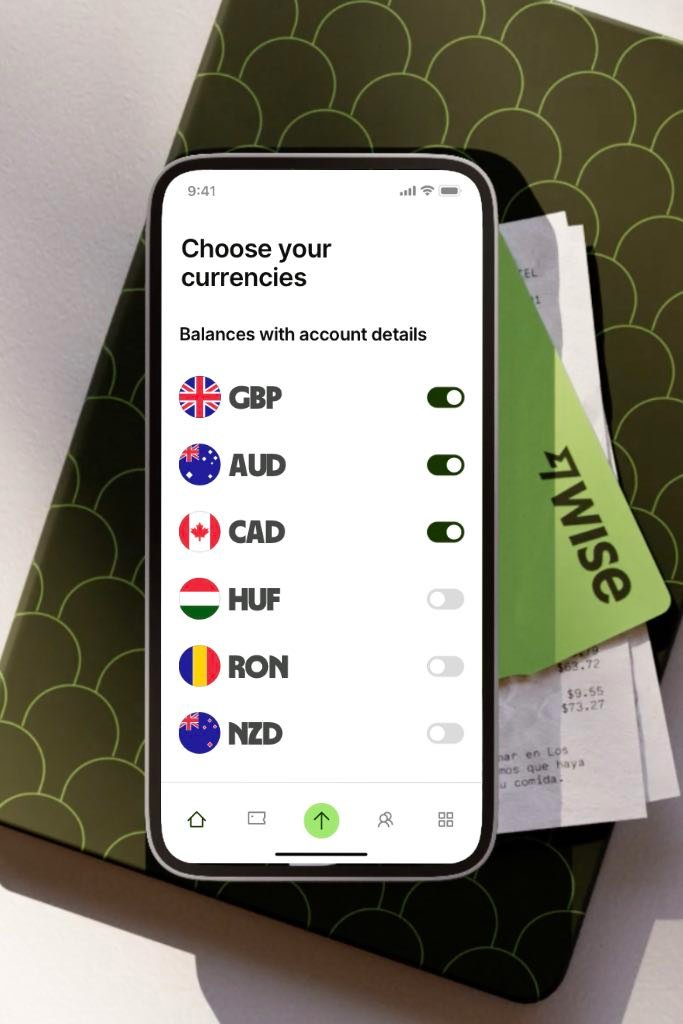

Visit Wise for more information on their foreign currency accounts, debit card and mobile phone app.